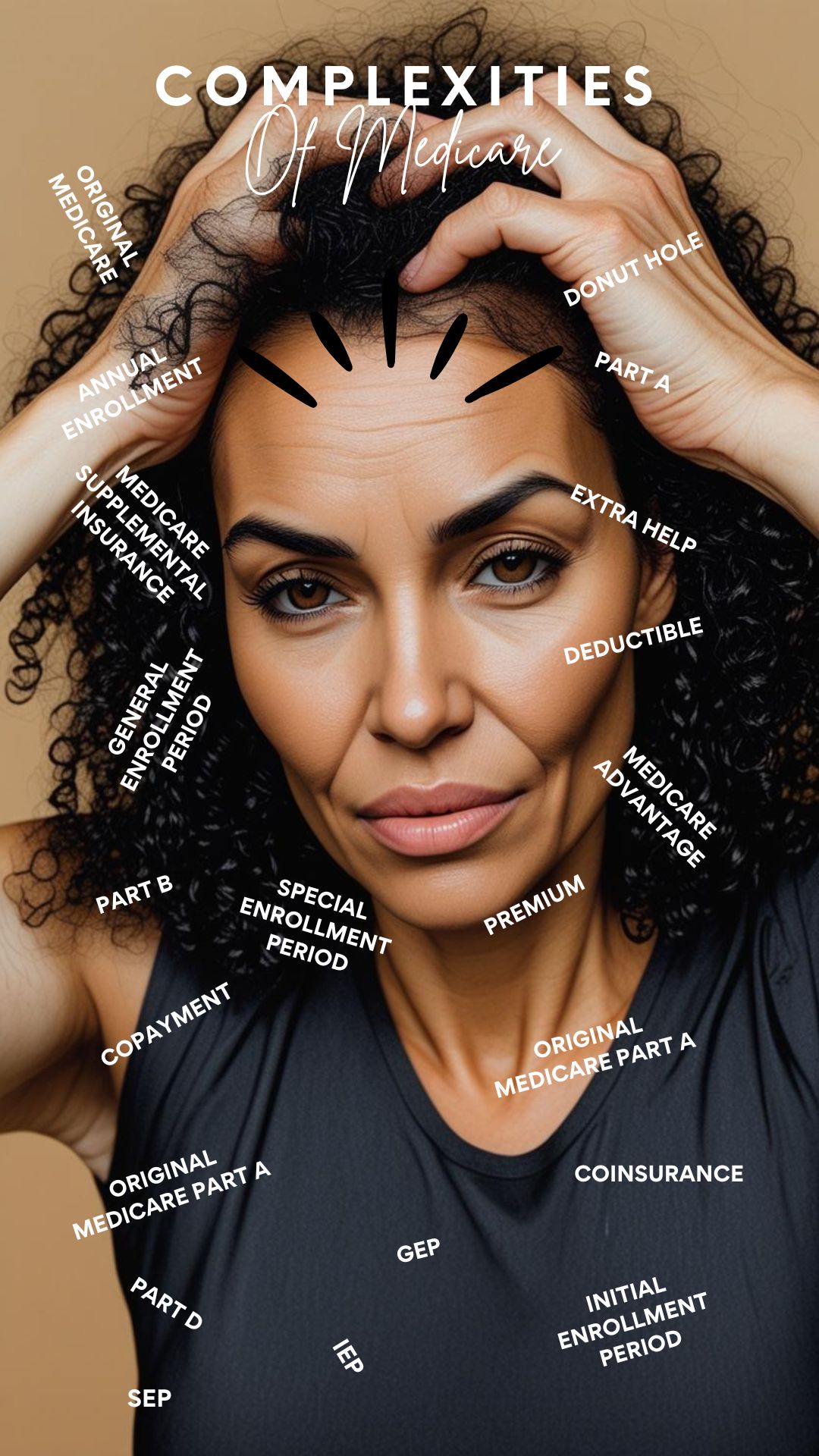

As you approach your 65th birthday, your mailbox might transform into a daily deluge of Medicare-related letters, brochures, and advertisements. Each piece promises something different, uses unfamiliar jargon, and seems to contradict the last. If you’re feeling overwhelmed, frustrated, and utterly confused by this Medicare enrollment confusion, you are absolutely not alone. This cascade of information, rather than clarifying, often leaves seniors feeling more anxious than informed.

But here’s the critical truth: this confusion isn’t just annoying; it can lead to missing critical deadlines and, terrifyingly, incurring a lifetime Medicare Part B surcharge. This isn’t a temporary fine; it’s a permanent increase to your monthly premium that can chip away at your hard-earned retirement savings for decades. The fear of making a costly mistake, of being penalized for simply not understanding the intricate rules, is a very real and valid concern.

This guide is your lifeline. Crafted by a trusted Medicare advisor with years of experience simplifying these complexities for seniors, we’re here to cut through the noise, demystify the essential information, and provide a clear, actionable path to avoiding lifetime penalties on your Part B premium. Our commitment is to provide clear, trustworthy guidance that respects your time and intelligence, ensuring your peace of mind and protecting your financial future.

💡 “3.8 Million in Denied Claims Overturned—Here’s How You Can Too!”

The Elephant in Your Mailbox: What is the Medicare Part B Surcharge?

Let’s confront the core issue head-on: the Medicare Part B surcharge, more formally known as the late enrollment penalty. This isn’t some arbitrary fee; it’s a mechanism designed to ensure fairness within the Medicare system.

Unpacking the Medicare Part B Surcharge (Late Enrollment Penalty)

Why Medicare Penalizes Late Enrollment: The “Risk Pool” Explained

Medicare operates on the principle of a “risk pool.” For the system to remain stable and affordable for everyone, it needs a balance of healthy individuals contributing premiums alongside those who require more extensive medical care. If people could simply wait until they were sick to enroll, the system would quickly become unsustainable. The penalty incentivizes timely enrollment, ensuring a balanced pool of participants from the start.

The Costly Calculation: How Your Part B Late Enrollment Penalty Adds Up

The Part B late enrollment penalty is particularly impactful because it’s a percentage added to your monthly premium, and it sticks with you for life. Here’s how it works:

For every full 12-month period you were eligible for Medicare Part B but didn’t enroll (and didn’t have other qualifying coverage), your monthly premium will increase by 10%.

Let’s look at a concrete example. The standard Annual Medicare Part B premium for 2025 is projected to be around $185.

- If you delayed enrollment for one full year (12 months) without qualifying coverage, your penalty would be 10% of $185, which is $18.50. Your new monthly premium would be $203.50.

- If you delayed for three full years (36 months), your penalty would be 30% (3 x 10%), adding $55.50 to your monthly premium. Your new premium would be $240.50.

This additional amount is not a one-time fee. It’s a lifetime Medicare premium increase that will be added to your Part B premium for as long as you have Part B coverage. Over decades in retirement, these penalties can add up to thousands of dollars that could have been used for other life expenses, making it a truly permanent financial burden.

Medicare Denial Survival Kit has helped clients reverse $3.8M+ in denied claims

Cutting Through the Clutter: Demystifying Your Medicare Mail Explained

The sheer volume of mail can be paralyzing. But once you know what to look for, you can cut through the clutter and identify the truly important documents.

Decoding Your Medicare Enrollment Mail and Important Letters

The Initial Enrollment Period (IEP) Packet: Don’t Toss This!

This is the most crucial piece of mail you’ll receive. As you approach your 65th birthday, you’ll get a “Welcome to Medicare” packet from the Social Security Administration (SSA). This packet contains your new Medicare card (if you’re automatically enrolled) and vital information about your Initial Enrollment Period (IEP).

Actionable Tip: Look for a red, white, and blue Medicare card. Even if you plan to delay Part B, this card signifies your eligibility and the start of your IEP. This packet will clearly outline your specific 7-month window for enrollment. If you’re unsure of your exact IEP dates, you can always visit Medicare.gov or contact the Social Security Administration directly.

Understanding Notices About Creditable Coverage for Part B

If you continue working past 65 and have health coverage through your employer (or your spouse’s employer), you might receive notices about creditable coverage. This term means your current health coverage is considered “as good as” Medicare’s for specific parts.

Actionable Tip: Keep any letters from your employer or health plan stating whether your coverage is “creditable” for Medicare Part B and Part D. This documentation is crucial if you ever need to prove to Medicare that you had valid coverage and should not be penalized for delaying enrollment. Understanding what creditable coverage means in simple terms is key to making informed decisions.

The Annual Notice of Change (ANOC) and Your Yearly Review

Once you’re enrolled in Medicare, you’ll receive an Annual Notice of Change (ANOC) from your plan each fall. While this isn’t about initial enrollment, it’s a vital piece of Medicare guidance for seniors for ongoing plan management. It details any changes to your plan’s costs, benefits, or covered drugs for the upcoming year. Don’t ignore it – it’s your opportunity to ensure your plan still meets your needs!

Your Simple Path: Avoiding the Lifetime Part B Surcharge

The good news is that avoiding the lifetime Part B surcharge is entirely possible with a clear understanding of two golden rules.

The Two Golden Rules: When to Enroll in Part B Without Penalty

Rule #1: Enroll During Your Initial Enrollment Period (IEP)

For most people, the simplest way to avoid penalties is to enroll in Medicare Part B during their Initial Enrollment Period (IEP). This 7-month window (3 months before, the month of, and 3 months after your 65th birthday) is your primary opportunity. Enrolling early in this window ensures your coverage begins on the first day of your birthday month, providing seamless transition and preventing any gaps.

If you’re already receiving Social Security benefits, you’ll likely be automatically enrolled in both Part A and Part B. This Social Security and Medicare enrollment link means you don’t have to do anything to sign up for these parts. However, you still have the option to decline Part B if you have other qualifying coverage (see Rule #2).

Rule #2: Qualify for a Special Enrollment Period (SEP) for Part B

If you miss your IEP, a Special Enrollment Period (SEP) for Part B is your only other chance to enroll without penalty. SEPs are specific periods that allow you to sign up outside the normal enrollment windows due to certain life events.

Employer Group Health Plan Medicare: The 20+ Employee Rule

This is the most common and important SEP. If you (or your spouse) are still working past age 65 and have health coverage through an employer that has 20 or more employees, you can typically delay Part B enrollment without penalty. Your SEP to enroll in Part B will open for 8 months after your employment ends or your group health plan coverage ends (whichever comes first).

Why COBRA and Medicare Part B is a Common Trap

Here’s where many seniors make a critical Medicare enrollment mistake. While COBRA allows you to continue your employer’s health plan for a limited time, it does NOT count as active employer coverage for avoiding the Part B penalty. If you are 65 or older and only have COBRA, you need to enroll in Medicare Part B during your IEP or face penalties. Similarly, most retiree health insurance Part B plans are secondary to Medicare and do not qualify you to delay Part B without penalty. Always verify with your former employer or plan administrator.

Other SEP Scenarios: When Life Changes Mean an Opportunity

While less common, other life events can also trigger an SEP, such as moving to a new service area where your current plan isn’t available, losing Medicaid eligibility, or being released from incarceration. If you’ve experienced a significant life change, it’s always worth investigating if an SEP applies to you.

Your Action Plan for Clarity and Savings

Feeling less overwhelmed already? Good. Now, let’s turn that understanding into concrete steps to ensure your simplified Medicare enrollment and protect your savings.

Your Simplified Medicare Enrollment Checklist: Take Control

Step 1: Pinpoint Your Personal IEP Dates (and Set Reminders!)

This is foundational. If you’re approaching 65, use the Medicare.gov website’s tools or call the Social Security Administration to confirm your exact 7-month Initial Enrollment Period. Write it down, put it on your calendar, and set digital reminders. Knowing your Medicare enrollment deadlines is your first line of defense.

Step 2: Verify Your Current Coverage Status (Get it in Writing!)

If you’re working past 65, contact your Human Resources department immediately. Ask them:

- How many employees does the company have? (Crucial for

employer group health plan Medicarerules). - Is my current health plan considered “creditable coverage” for Medicare Part B?

- Is my prescription drug coverage “creditable” for Medicare Part D?

- Request written confirmation of your

creditable coveragestatus. This documentation is vital.

👉 GET THE DENIAL-FIGHTING TOOLS NOW

Step 3: Decide Your Enrollment Path (and Act on Time!)

Based on your IEP dates and current coverage status, make a clear decision:

- If you don’t have qualifying employer coverage, enroll in Part B during your IEP.

- If you do have qualifying employer coverage, understand when your SEP begins after that coverage ends, and plan to enroll within that 8-month window.

Step 4: Seek Expert Help: Don’t Go It Alone!

You don’t have to navigate this alone. For free, unbiased Medicare enrollment assistance, contact your State Health Insurance Assistance Program (SHIP). Their counselors are trained to help seniors understand their options and avoid pitfalls. If you prefer personalized, one-on-one support, consider consulting a Medicare expert or a licensed independent Medicare advisor in your area. They can simplify complex choices and provide tailored guidance.

Conclusion: Clarity Achieved, Savings Locked In.

The Medicare enrollment confusion that fills mailboxes and minds doesn’t have to lead to a lifetime Part B surcharge. By understanding the basic rules, knowing your personal deadlines, and taking proactive steps, you can confidently navigate this transition.

The profound relief and financial security that comes from avoiding lifetime penalties and locking in your savings is immeasurable. Imagine the peace of mind with Medicare coverage – knowing your healthcare is secure, your budget is protected, and you can truly focus on enjoying the retirement you’ve worked so hard for. Don’t let confusion win. Take control of your Medicare journey today.

Leave a Reply